Congratulations to Josef Teichmann and Thomas Krabichler who have convinced our jury with their work on Deep ALM.

The winning team convinced us with their work on Deep ALM:

Deep ALM is a feasible approach to solving the most computationally challenging optimization problems in financial mathematics, e.g. portfolio optimization considering a large number of investment- and regulatory constraints.

The ceremony took place on 26.10 in Sheraton Hotel during our flagship event Predictions for a new world order after COVID-19.

Check out video of ceremony: https://youtu.be/ajAYLmYzTYI

The Top 5 (ordered by date of nomination)

| Nominated (Organisation) | Nominated for | |||

| Dorian Credé (Wikirating) | Wikirating: the first free, collaborative and non-profit credit rating platform in the world, utilizing crowd intelligence. Open and collaborative alternative to classic credit rating agencies. https://wikirating.org | |||

| Gianluca De Nard, Robert F. Engle, Olivier Ledoit, Michael Wolf (UZH, NYU Stern, others) | Large Dynamic Covariance Matrices: Enhancements Based on Intraday Data, allowing for computationally feasible correlation estimation also for large dimensions of assets (N>1000). https://bit.ly/3jEQsr5 | |||

| Josef Teichmann, Thomas Krabichler (ETH, OST) | Deep ALM: a feasible approach to solving the most computationally challenging optimization problems in financial mathematics, e.g. portfolio optimization considering a large number of investment- and regulatory constraints. https://arxiv.org/abs/2009.05034 | |||

| Elias Loki (Credit Suisse IWM CRO organization) | Efficient solution for intraday reporting on shortfalls: time savings in the critical process of margin calls and shortfalls remediation (about 1 hour per day per Credit Officer saved). (Document is confidential) | |||

| Eric Schaaning, Michael Baes (European Systemic Risk Board) | Reverse Stress Testing: Algorithmic and systematic approach to generate “worst case” stress scenarios. This allows vulnerable institutions to be identified through systemwide stress tests that considers contagion, and then submitted to stronger supervisory scrutiny. https://bit.ly/2Ji6t9X |

About the Swiss Risk Award

The Swiss Risk Award is an annual award for the best contribution to risk management. This can be a project or product made by an individual or group/team. It must have been made for the most part in Switzerland or for company/institution with head office in CH. The winner will be given a cash prize of CHF 2’500 and chance to present at a high profile venue.

Judging and criteria

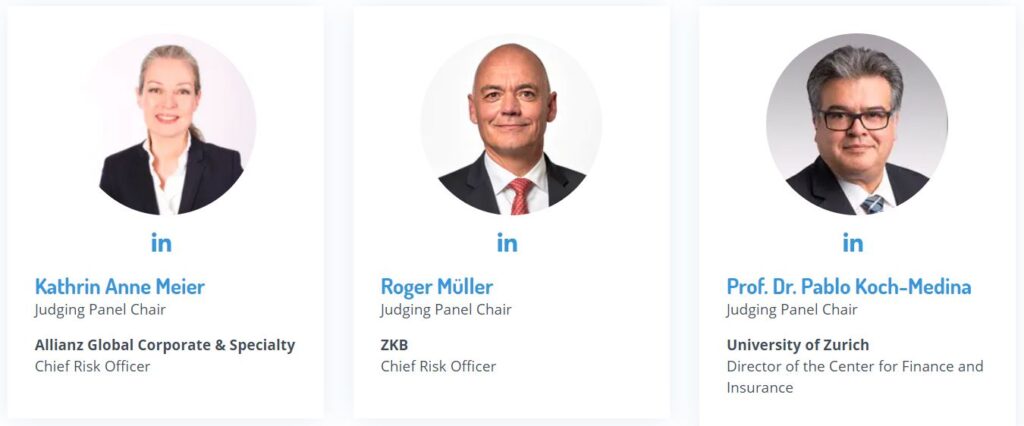

The judging is done in several steps – the final decision who of the Top 5 will win the award was done by this years judging panel: Kathrin Meier (Allianz), Roger Müller (ZKB), Pablo Koch (UZH).

For each nominee, each judge should rate along each of the following criteria:

- Practical Impact: Improves (or has potential to improve) effectiveness/efficiency of risk management practices at a micro- or macro level

- Originality/creativity: Candidates are “thinking outside the box” as well as “looking at the bigger picture” while pushing/expanding the intellectual boundaries

- Societal impact: What is the potential application in contributing to the risk management system from a societal perspective? I.e. is there a broader benefit for society?

Learn more about the Swiss Risk Award.